Building stronger communities together

Explore frequently asked questions from potential homeowners.

- I’m interested in owning a Habitat for Humanity home. What is the first step?

- Which county do I need to live or work in to apply for homeownership with Dubuque/Jackson Counties Habitat for Humanity?

- Do I have to be a citizen of the USA to own a Habitat home?

- With whom does Habitat for Humanity build homes?

- Do I have to be a Christian to work with Habitat for Humanity?

- What if I apply and qualify but am not accepted into partnership?

- How many Dubuque/Jackson Counties Habitat for Humanity homeowners have gone into default on the mortgage and lost their home?

- Does a Habitat for Humanity homeowner make a down payment for their house?

- How long does it take to get a Dubuque/Jackson Counties Habitat for Humanity house?

- How much does a Habitat for Humanity house cost?

- Is Dubuque/Jackson Counties Habitat for Humanity funded by the government or Habitat for Humanity International (HFHI)?

-

I’m interested in owning a Habitat for Humanity home. What is the first step?

The first step is to visit the Dubuque/Jackson Counties Habitat for Humanity How to Qualify page to discover if you qualify for our program.

-

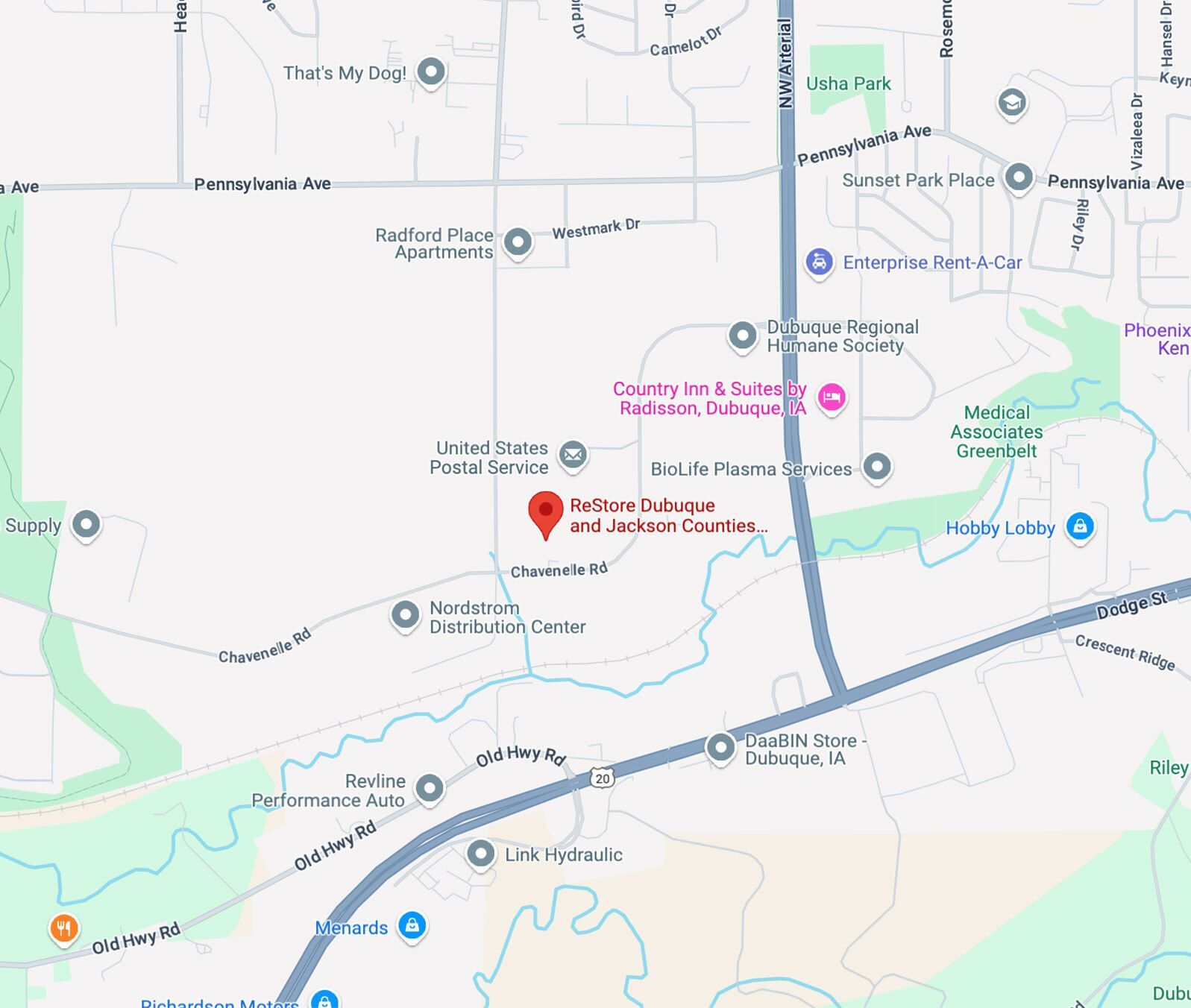

Which county do I need to live or work in to apply for homeownership with Dubuque/Jackson Counties Habitat for Humanity?

You must be willing to live in either Dubuque or Jackson county. You do not have to live or work in the county to apply, but you do need to be able to actively participate in sweat equity, homeowner education, and other activities required in the Partnership Agreement.

-

Do I have to be a citizen of the USA to own a Habitat home?

You must be a permanent legal resident or citizen of the United States of America to qualify for the Habitat for Humanity Homeownership program.

-

With whom does Habitat for Humanity build homes?

Habitat builds homes with people in need of better housing who are able to pay an affordable mortgage, and willing to partner. Habitat is an Equal Credit Opportunity Lender and we are pledged to the letter and spirit of U.S. policy of achievement of equal housing opportunity throughout the nation. We encourage and support an affirmative advertising and marketing program in which there are no barriers to obtaining housing because of race, color, religion, sex, handicap, familial status, national origin, age, marital status, source of income, gender identity, or sexual orientation.

-

Do I have to be a Christian to work with Habitat for Humanity?

No. Religion is not considered when evaluating applications for our programs. We welcome volunteers from all faiths, or no faith, who can actively embrace Habitat for Humanity's vision of a world where everyone has a decent place to live and our mission to bring people together to build homes, communities, and hope.

-

What if I apply and qualify but am not accepted into partnership?

Many qualified applicants will not be invited to join the program. You may, however, re-apply during the next application period. At any step in the application process, an application may be denied for a variety of reasons, including but not limited to: need, unsatisfactory credit or debt-to-income ratio, yearly income failing to meet guidelines, providing inaccurate information on the application, family instability, or failure to meet obligations in the Partnership Agreement.

-

How many Dubuque/Jackson Counties Habitat for Humanity homeowners have gone into default on the mortgage and lost their home?

Eight percent of homeowners have gone into default and lost their homes. The Homeowner Selection & Support Committee evaluates each application thoroughly and selects households that are prepared for successful home ownership. Upon sale of the home to the qualified applicants, we ensure that homeowners will spend no more than 30% of their income on housing costs. The homes we build are energy efficient and designed to limit energy costs. Combined, these efforts make nearly all households in our program successful homeowners; however, if payments are not made, Habitat will exercise legal actions to correct default.

-

Does a Habitat for Humanity homeowner make a down payment for their house?

Each adult homeowner signs a Partnership Agreement. A $500 refundable deposit is paid at the agreement signing. If the family purchases the home, the $500 is used toward the purchase. Each adult agrees to contribute 200-300 hours of sweat equity toward the purchase of their home. Sweat equity is both an investment in the value of their home and a way to gain home maintenance knowledge. The value of this partnership becomes the down payment.

In some cases, local governments may offer homeownership programs. These programs can provide thousands of dollars in down payment assistance. When these programs are available, Habitat works with homeowners to save 3% of the purchase price of the property.

-

How long does it take to get a Dubuque/Jackson Counties Habitat for Humanity house?

You will receive a response from Habitat from Humanity regarding your qualifications withing 30 days of applying. Qualifying applications are then reviewed by the Homeowner Selection Committee and the Board of Directors. It takes up to three months for the Homeowner Selection Committee to review and decide on each application. Once accepted into the Homeownership Program, it often takes 12-24 months to accrue sweat equity and build the home.

-

How much does a Habitat for Humanity house cost?

Each home we build or renovate will vary depending on the layout and location. We sell our homes to qualified home buyers at AMV (appraised market value). The length of mortgage is determined by income. There is no penalty for any home buyer who chooses to pay off the balance in advance.

-

Is Dubuque/Jackson Counties Habitat for Humanity funded by the government or Habitat for Humanity International (HFHI)?

Our affiliate is a self-sufficient and independent 501(c)(3) non-profit organization. HFHI supports our affiliate by coordinating some national sponsorship opportunities and provides us with our logo, training, and grant resources. We are responsible for funding all home builds, renovation projects, and critical home repairs. We look to businesses, faith organizations, service groups, and individuals within our area to help us in assisting more homeowners achieve strength, stability, and self-reliance through homeownership.

Notice: The federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age; because all or part of the applicant’s income derives from any public assistance program; or because the applicant has exercised in good faith any right under the Consumer Trade Commission, Washington, D.C. 30580

We are pledged to the letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the nation. We encourage and support an affirmative advertising and marketing program in which there are no barriers to obtaining housing because of race, color, religion, sex, handicap, familial status, national origin, age, marital status, or sources of income.